⚠️ Note: For up to date informations please visit: https://docs.palmswap.org

In the following two series you will get an insight into the Palmswap Protocol, Tokenomics and the future of Palmswap.

Palmswap Protocol is a decentralized perpetual contract protocol for every asset, enabled by a Automated Market Maker & Order Type DEX.

For those who aren’t familiar with perpetual contracts: A perpetual contract is a derivative similar to a futures contract but without an expiry date. We offer perpetuals similar to those of other centralized services: FTX, Bybit, Bitmex and more.

The two DEX Protocols of Palmswap & the differences:

To meet the needs of all traders there will be two DEX Protocols of Palmswap.

📈 The v1 Protocol

uses vAMM for settlement and meets the needs of small to medium size traders, 100% on-chain. Here a maximum position size of $50,000 on a single market is recommended, thus you will receive a good spread & enjoy the secured liquidity benefits of vAMM.

Just like Pancakeswap, traders on v1 can trade directly with our virtual AMMs without the need of a counterparty. The virtual AMMs offer guaranteed on-chain liquidity.

Launch: February 2022

Key Features of v1: vAMM

- 10x Leverage On-Chain Perpetual Contract

Traders can trade with up to 10x leverage long or short, have transparent fees and 24/7 guaranteed liquidity. - Guaranteed Liquidity Provided by vAMM

Every asset can be supported via a perpetual contract on the Palmswap Protocol. - Order Types

via integrated smart wallets, users have the possibility to place different types of orders.

📈 The v2 Protocol

is the next goal after the launch of v1 on Mainnet. A hybrid infrastructure model that uses a non-custodial on-chain settlement and an off-chain matching engine with low latency and order books. This means that traders with large sums can enjoy low slippage.

With a order type, they trade as on central exchanges with a counterparty, whose settlement runs through the so-called order books.

Launch: Q3/4 2022

Key Features of v2: Order Type (hybrid)

- 50x Leverage On-Chain Perpetual Contract

Traders can trade with up to 50x leverage long or short, have low fees, 24/7 liquidity, and low slippage. - Spread similar as usually on Central Derivatives Exchanges

Keeping an order book enables a better spread. - Decentralized Hedge Funds

Anyone can create or participate in decentralized hedge funds. A pre-determined profit share and automated periodic payout are locked into smart contracts, creating new opportunities for the client and fund manager. - Fast execution

A mix of on-chain trade execution and off-chain order book management will allow us to execute positions faster.

🤔 Okay, understood but what is virtual AMM used for in v1?

You can think of vAMM as the AMM (x*y=k) used by Pancakeswap to settle token swaps, while in Pancakeswap’s AMM liquidity must be deposited for pairs, as the “v” in front of vAMM indicates on Palmswap Protocol this liquidity is virtual, the formula for the constant product x*y=k is the same. This vAMM design provided by Perpetual Protocol on the ETH network allows trading without liquidity, good spread for small traders and on-chain settlement.

and this is how it works while you trade:

Protocol Fee Distribution

The team does not earn anything from the protocol revenue.

In order to create a fair DAO-driven protocol, the protocol revenue will go back into the ecosystem:

- 50% buyback & burn of PALM tokens

- 50% security fund to secure the protocol

(Both addresses can be publicly viewed by anyone)

🔮 The Dream?

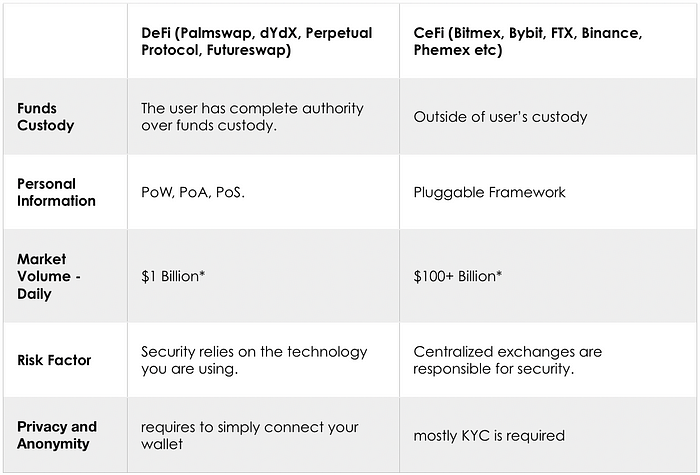

The decentralized perpetual market accounts for just 1% of the volume of centralized derivatives market. By 2025, DeFI should play a more dominant role than it does now. Palmswap Protocol will primarily focus on perpetuals and work together with other projects to support the shift from CeFi to DeFi.

🖊 Conclusion

Above we explained how the protocol works. The next series 2/2 will published in a few days and will give you an introduction to our tokenomics.

Feel free to ask us questions on our Discord server or post them in our Telegram group.